How to mitigate supply chain tariffs

This is the subject of many panel discussions and articles over the last couple of weeks. As someone who has made products in the US, Mexico, Brazil, South Korea, and China (as well as starting inroads into Canada, Indonesia, Malaysia, Thailand, India, and Vietnam), I have some thoughts.

Do Nothing – Given the day-to-day, week-to-week, and ongoing “90 trade deals in 90 days” work, doing nothing is not unreasonable. Changing supply chains costs time and money. If a tariff is eliminated, never instituted, or drastically reduced from a bombastic high, these efforts will be wasted. However, for goods made in China with a 100%+ tariff, doing nothing is problematic.

Move Back to the US – This may not be viable for many products. Products that left the US did so due to high labor costs or similar drivers, and that doesn’t change even under 200%+ tariffs. Moreover, supporting industries may no longer exist in the US, and/or US suppliers may already be swamped, such as injection molders, making this solution not as viable as the current administration would like.

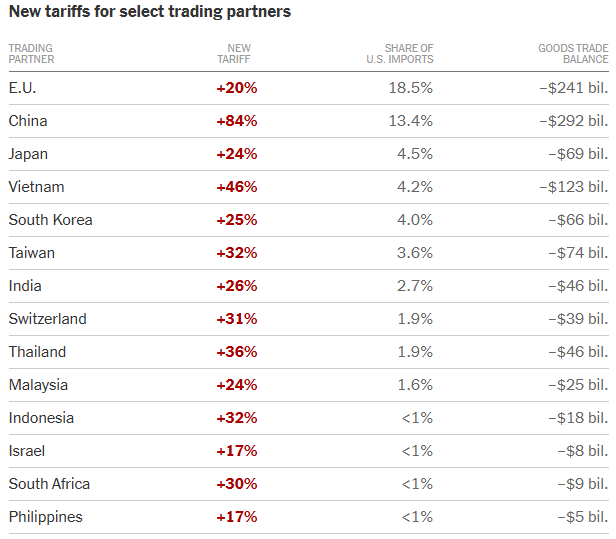

Move to Another Low-Cost Supplier Country – Right now, most countries are trying to negotiate to reduce the tariff burden for their goods, and all are starting from a point much lower than China’s. For example, Malaysia is at 24% (as of April 2, 2025). Many companies started to look at alternatives to China after the initial Trump tariffs and China’s disruptive response to COVID-19. The current trade war provides more incentive.

Source: New York Times, April 2, 2025 (link)

My comments thus far are based on the assumption that your OEM or ODM is located outside of the US and makes your product using a local supply chain. The reality is that supply chains are sometimes more diverse than this assumption would imply.

Move Some Operations to a USMCA Country – USMCA, or NAFTA 2.0, allows for no tariffs on “compliant goods.” If a component is “substantially transformed” in North America using non-USMCA parts, it’s tariff-free. If 10% or less of the value is from non-USMCA goods, then it’s tariff-free. Some larger OEM/ODMs have facilities in multiple countries. Making some components in their current location then doing final assembly or secondary operations in Mexico or Canada could alleviate painful tariffs.

This will be a tough time to manage supply chains, not seen since COVID and shortly after. Best of luck, and let us know if you need help re-sourcing!

Disclaimer: This article should not be taken as legal or tax advice. Consult an appropriate expert on your strategy.